Why DocuBay

Services

License & Compliance Management

HR & Employment

Permits & Approvals

Insurance & Risk Management

Legal Services

Tax & Finance

Company Formation

Effortless Corporate Tax Registration in UAE

Navigate UAE's Corporate Tax law with ease. DocuBay simplifies registration, saving you time and money.

Understanding UAE’s Corporate Tax

The UAE's Corporate Tax regime is designed to support economic growth and diversification. Businesses with taxable income exceeding AED 375,000 are subject to a 9% Corporate Tax. This applies to both resident and non-resident companies conducting business activities in the UAE. It's crucial to understand your obligations under the new law to ensure compliance and avoid penalties.

Benefits of Compliance

Timely registration with the Federal Tax Authority (FTA) demonstrates your commitment to legal compliance and strengthens your business reputation. It also allows you to access the benefits and incentives offered under the Corporate Tax law. Furthermore, being registered helps you avoid potential penalties and disruptions to your business operations.

Potential Challenges

Navigating the FTA's online portal, understanding the specific documentation requirements, and meeting deadlines can be challenging. Many businesses find the process time-consuming and complex, especially when dealing with other operational priorities.

Simplify Your Corporate Tax Registration with DocuBay

DocuBay makes Corporate Tax registration hassle-free with expert guidance and end-to-end support. From consultation to FTA submission, we ensure your business stays compliant.

- 1

Submit Your Request

Start your application through the DocuBay app (for registered users) or email us if you’re new.

- 2

Consultation & Expert Guidance

Receive tailored advice to align your tax registration with your business requirements.

- 3

Document Preparation

We assist you in gathering and organizing all required documents to meet FTA standards.

- 4

FTA Registration

Your application is submitted with precision, ensuring compliance with UAE tax regulations.

Do you need ⎯

some help?

We understand navigating legal and corporate processes can be complex. Let us guide you every step of the way to ensure a smooth, hassle-free experience.

Speak to an Expert

Who is required to register for Corporate Tax in the UAE?

Entities and individuals conducting taxable activities within the UAE with annual taxable income exceeding AED 375,000 must register for Corporate Tax. This includes:

- Limited Liability Companies (LLCs)

- Public Joint Stock Companies

- Branches of Foreign Companies

- Free Zone Businesses (even if they qualify for 0% Corporate Tax under certain conditions)

- Natural Persons engaged in business activities exceeding the income threshold

Note: Exempt entities such as government bodies, certain public benefit organizations, and qualifying investment funds may also need to register based on Federal Tax Authority (FTA) directives.

What is the deadline for Corporate Tax registration?

The deadline for Corporate Tax registration depends on your financial year and license issuance date. Businesses are generally required to register before filing their first Corporate Tax return. Missing the deadline can result in fines of up to AED 10,000 for late registration.

For Free Zone businesses: Registration is mandatory even if the company meets the criteria for 0% tax, as per UAE Corporate Tax law.

What documents are required for Corporate Tax registration?

The typical documentation required includes:

- Trade License: Valid license issued by the relevant authority (DED or Free Zone).

- Memorandum and Articles of Association (MoA): Outlines the company’s structure and purpose.

- Passport Copies: For shareholders, directors, and authorized signatories.

- Emirates ID Copies: For shareholders, directors, and authorized signatories.

- Board Resolution: Approving the tax registration process.

- Proof of Business Activity: Contracts, invoices, or other evidence of operations.

- Financial Statements: If available.

- Additional Documents: Depending on specific FTA requirements.

DocuBay will provide a tailored checklist to simplify the process for you.

Do Free Zone businesses need to register for Corporate Tax?

Yes, Free Zone businesses are required to register for Corporate Tax even if they meet the conditions to qualify for a 0% tax rate. These businesses must still comply with filing requirements and submit annual Corporate Tax returns.

Qualifying Free Zone businesses must ensure they maintain compliance with all conditions to retain the 0% tax rate, including generating qualifying income and adhering to regulatory requirements.

What are the penalties for non-compliance with Corporate Tax regulations?

Failure to comply with Corporate Tax regulations can result in:

- Financial Penalties: Fines starting from AED 10,000 for late registration or failure to submit returns.

- Late Payment Fees: Additional charges for delayed tax payments.

- Legal Action: Potential legal consequences for continued non-compliance.

Timely registration and compliance with tax obligations are essential to avoid these repercussions.

How much does it cost to register for Corporate Tax with DocuBay?

DocuBay offers competitive and transparent pricing for Corporate Tax registration services. Our packages start from AED 2,000 and include:

- Consultation to understand your business requirements

- Assistance with document preparation and organization

- Step-by-step guidance through the FTA registration process

Contact us for a personalized quote and a detailed breakdown of services.

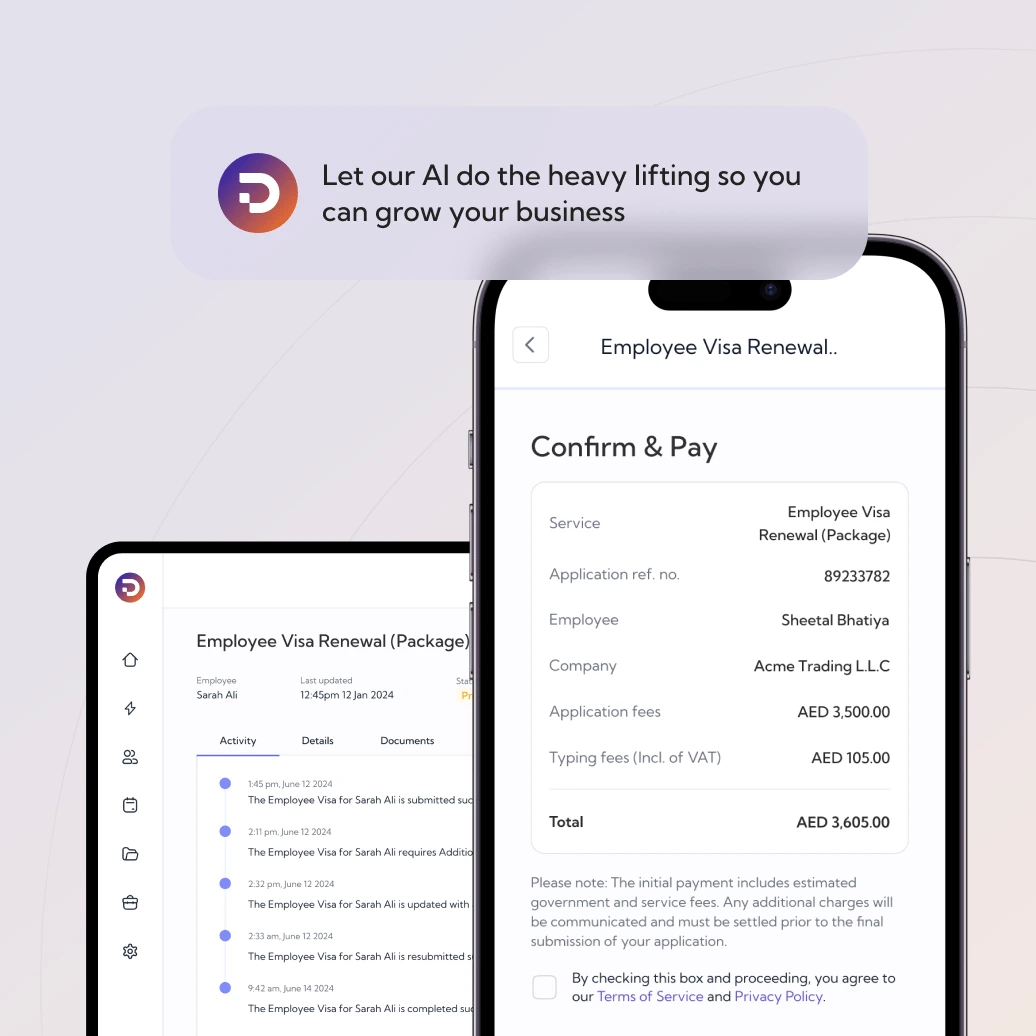

Why Choose DocuBay: Simplify, Streamline, and Succeed in the UAE

All-in-One Platform for Business Services

DocuBay brings every critical workflow into one secure dashboard; from licence-lifecycle management to specialist legal support. so you can run and scale your business with confidence.

Licence-Lifecycle Management with guided workflows.

Employment & Residency (Manage labour contracts, MOHRE category, and much more.)

Permits & Approvals (secure NOCs and clearances without bottlenecks.)

Legal & Corporate Services (contracts, attestations, translations, tax advisory, and more.)

Entity Management (add new licences or activities as your organisation grows.)

Robust Compliance & Risk Management

Our AI-powered engine keeps you audit-ready by catching issues early, monitoring regulatory changes, and delivering real‑time risk insights.

AI Pre-Validation (verify applications against live requirements before submission.)

Integrated KYC & Background Checks (screen partners and stakeholders in seconds.)

Risk Dashboard (instant alerts for upcoming filings, expiries, and compliance gaps.)

Centralised Document Vault (secure storage with version control and role-based access.)

Smart Reminders & Regulatory Tracking (never miss a deadline or policy update.)

Expert Guidance & Support

Lean on a team that understands UAE regulations inside out backed by 24/7 assistance and rich learning resources.

On-Demand Legal & Compliance Consultation

Dedicated Account Manager (Tailored business support)

Dedicated Account Managers

Knowledge Portal (step-by-step guides, FAQs, and best-practice templates.)

Webinars & Training Sessions (stay ahead of new legislation and industry trends.)

24/7 Live Chat & Email Support. immediate help, day or night.

What Our Clients Say

Simplify Your Business Compliance with DocuBay

Let DocuBay handle your compliance needs for hassle-free Corporate Tax registration.

* Prices and services are subject to change. ** Timeframes are estimates and may vary. For full details, please review our Terms of Service.

This website is solely owned by DocuBay (Sygneo Systems FZCO) and is not affiliated by any government owned/based authority.